Audits, Reviews & Compilations for Businesses and Organizations

As you go through the daily operations of your business or organization, you’re probably not thinking about the completeness and accuracy of your financial statements. But it’s likely in the back of your mind… a little voice reminding you that, whether for legal requirements or lender curiosity, an examination of your financials is on the horizon. Or maybe your organization is a nonprofit or government entity for which a full audit is required.

James Moore, an audit firm, addresses your assurance needs thoroughly and efficiently. We’ll keep an eye on your statements and procedures, allowing you to focus on your business or mission at hand.

Having performed assurance services for over 50 years, our CPAs are well versed on the evidence needed to satisfy the framework and requirements that apply to you—from federal and state regulations to generally accepted accounting principles (GAAP).

You might not need a sledgehammer to kill that fly.

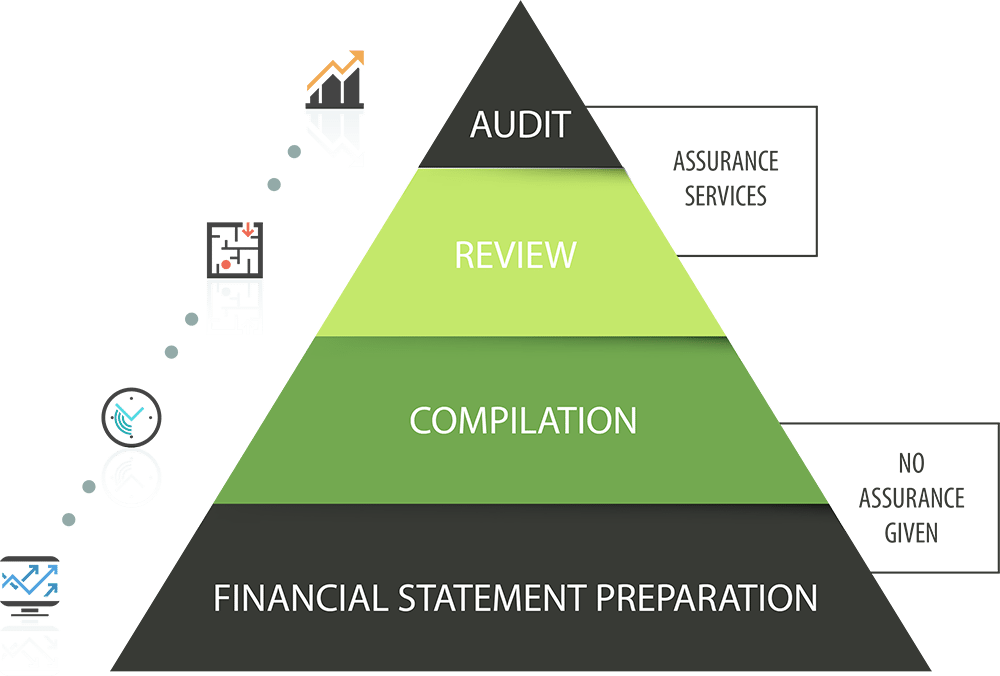

There are several types of assurance services available at our audit firm. Determining the best option for you will help ensure that you’re meeting stringent requirements—or save you thousands of dollars in fees and countless hours of preparation.

Audit – The highest level of assurance you can obtain, audits are required for government entities, some nonprofits (and other organizations), and businesses with loan covenant and bonding requirements. An audit thoroughly examines the completeness and accuracy of your financial statements through customized risk-based audit procedures and testing. The deliverable is our audit opinion, a full set of financial statements and note disclosures.

Review – A review is ideal for smaller businesses, organizations or nonprofits with simpler funding sources. It provides limited assurance that no material modifications are needed to make your financial statements compliant with GAAP. The review report includes a full set of financial statements and note disclosures, but no opinions. It’s a less expensive option that still provides a basic level of assurance on the accuracy of your financial statements.

Compilation – Maybe all you need is a simple statement about your financial statements. A compilation informs a lender or other outside party that your financial statements are appropriately prepared in accordance with GAAP. This brief report, printed on our firm’s letterhead, demonstrates your commitment to sound reporting. Compiled financial statements represent the most basic level of service we can provide with respect to your financial statements.

Need a narrower focus? Read about our agreed-upon procedures.

Need more information? Check out our library of related articles.

Construction Bonding: How James Moore Can Help

In the construction industry, securing a construction bond is often the key to unlocking bigger…

Planned Giving Via Externally Managed Trusts: Balancing Donor Intent with Foundation Policy

In the realm of higher education philanthropy, substantial donor contributions are pivotal in advancing institutional…

Is Your Organization Making These Single Audit Errors?

Think of a single audit as your organization’s federal funding report card — except the…

Construction Bonding: What Does a Surety Want to See?

When bidding on public or private construction projects, contractors often face a critical requirement: securing…

Be the First to Hear.

Sign up for our newsletter and have it delivered to your inbox, so you don’t miss a thing.

Professional Affiliations

Zach Chalifour, CPA

Partner

Zach has nearly 20 years of CPA experience and leads our firm’s Assurance service line and Municipal Finance Support Services Team. Also the leader of the firm’s Government Services team, Zach works almost exclusively with governmental entities with budgets ranging from $1 million to over $1 billion. Zach works extensively with organizations that receive substantial federal and state assistance subject to the OMB Uniform Guidance and the Florida Single Audit Act of up to and over $100 million. Zach also brings a unique perspective to his engagements based on his inside working knowledge of local government finance, having served as the contract Finance Director for the City of Lake Helen since early 2019.

Zach serves as an Annual Comprehensive Financial Report (ACFR) reviewer for the Government Finance Officers Association (GFOA). He has worked with numerous clients to assist in the early implementation of new GASB standards. Zach also leads the teams providing contracted Tourist Development Tax (TDT) audit assistance to various counties.

Additionally, Zach maintains memberships with a variety of government-industry groups including the Florida Government Finance Officers Association (FGFOA), the Government Finance Officers Association (GFOA), the Volusia League of Cities, the Space Coast League of Cities, and the Florida Tourist Development Tax Association (FTDTA). Zach is a frequent speaker at conferences and other events across the state, and has previously spoken for the following associations on various governmental accounting and auditing topics:

- Florida Government Finance Officers’ Association (Annual Conference, School of Government Finance, Webinar Series)

- FGFOA Local Chapters (Volusia/Flagler, Big Bend, Treasure Coast, North Central Florida)

- Florida Tax Collectors Association

- Florida Tourist Development Tax Association

- Florida Institute of Certified Public Accountants

- Florida School Finance Officers Association