CPAs and Consultants for Head Start Organizations and Community Action Agencies

You work hard to serve your community, but the pressure to meet strict financial regulations can be overwhelming. Plus you’re being asked to serve more children, raise pay for staff and provide better training — all without increases to your grants.

Doing more with less is a constant challenge for Head Start organizations and Community Action Agencies. And if your grants aren’t in order, funding can be at risk. With so many rules around how grant money can be used, it’s important to have the right support on your side.

That’s why so many organizations turn to us for help with audit and assurance services, accounting controllership services, tax compliance, nonprofit consulting and general peace of mind.

The Value of an Extra (Knowledgeable) Perspective

Sometimes, the best way to solve a challenge is to bring in a fresh set of eyes. At James Moore, we give Head Start organizations and Community Action Agencies the extra perspective and expertise they need to stay strong.

We understand your world of tight budgets, strict rules and the pressure to do more without more funding. Our nonprofit team knows what reviewers look for and how to spot issues before they become problems. We can help fine-tune your cost plans, prep for audits and support your staff so you’re not carrying it all alone. Together we’ll help you meet you’re your stringent requirements and make the most of every dollar

With us, you get more than a checklist. You get insight from people who know your programs and care about your mission.

What can we do for your Head Start or Community Action Agency?

Audit Preparation

Audit Preparation

Help your team get ready for grant reviews and audits with organized records and clear documentation.

Uniform Guidance (Single Audit) Support

Uniform Guidance (Single Audit) Support

Ensure compliance with Uniform Guidance rules and get help managing the extra steps of a single audit.

Compliance Consulting

Compliance Consulting

Protect your funding with expert guidance on grant spending and cost allocation planning that supports your programs and meets federal requirements.

Financial Statement/Single Audits

Financial Statement/Single Audits

Provide independent audits that meet federal requirements and give funders confidence in your reporting.

Internal Controls Assessment

Internal Controls Assessment

Evaluate your processes to reduce risk, improve accountability, and strengthen financial oversight.

Outsourced Accounting Services

Outsourced Accounting Services

Get reliable support for day-to-day accounting to keep your books accurate, timely and aligned with grant and reporting requirements.

Board and Staff Training

Board and Staff Training

Train your team on financial responsibilities, compliance basics, and what to expect during reviews.

Budgeting and Forecasting Support

Budgeting and Forecasting Support

Develop realistic budgets and forecasts that align with grant goals and program needs.

Strategic Financial Consulting

Strategic Financial Consulting

Offer guidance on long-term planning, funding use, and how to do more with limited resources.

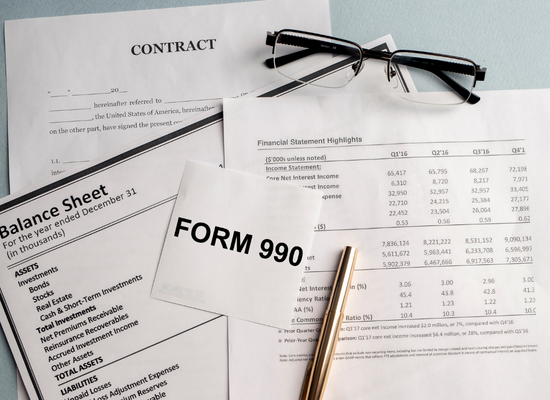

Form 990 and Tax Compliance

Form 990 and Tax Compliance

Prepare and review your nonprofit tax filings to keep your organization in good standing.

Featured Articles on Head Start / Community Action Agency Services

Audit vs. Review: Which Does Your Nonprofit Need?

Nonprofit organizations play a vital role in our world: advancing important causes, providing services to…

Financial Considerations at Each Stage of the Nonprofit Life Cycle

Nonprofits are unique in that they’re launched in service of a mission rather than to…

The Function of Functional Expense Allocation

“The devil is in the details.” It’s an old saying about hidden, mysterious aspects of…

How Form 990 Can Boost Your Nonprofit’s Budget

Form 990 provides the IRS with essential information about tax-exempt organizations. Think of it as…

Be the First to Hear.

Sign up for our newsletter and have it delivered to your inbox, so you don’t miss a thing.

Corinne LaRoche, CPA

Partner

While Corinne serves as a trusted advisor and accountant for a variety of organizations, her heart lies in serving the needs of nonprofit organizations to address taxation issues and provide audit and assurance services as well as CFO and controllership services. Her client list includes an extensive number of entities that receive substantial federal and state assistance. She is a trusted authority on OMB Super Circular and the Florida Single Audit Act and a certified member of the AICPA’s Not-For-Profit section, making her a valuable resource to the firm and our nonprofit clients on all of their reporting, tax and business needs. As a result of this experience, she serves as an integral member of the firm’s Nonprofit Services Team.

Corinne’s experience also includes serving on local nonprofit boards. Her volunteer experience has given her a solid understanding of how nonprofits work and the challenges they face, from obtaining funding and operating with limited budgets to ensuring compliance and transparency. She uses both perspectives, as a participant and an accounting professional, to better serve her clients.

Katherine Munday, CPA

Director

Katherine is a certified public accountant in the state of Florida and has been with James Moore for the entirety of her career. She primarily handles nonprofit single audits and compliance testing, in particular larger clients with state/federal funding levels of at least $750,000. She also provides controller services for some of our nonprofit clients.

Katherine’s clientele includes workforce boards, community based care agencies, healthy start coalitions, music associations and other similar organizations. This work has given her deep experience and expertise in the nonprofit industry, and as such she is a key member of the firm’s Nonprofit Services Team.

Andrew Ferguson, CPA

Senior Manager

Andrew has over six years of professional auditing and accounting experience. He focuses primarily on nonprofit entities, in particular Community Action Agencies and Head Start programs. His extensive expertise in single audit requirements and OMB Uniform Grant Guidance has served these nonprofits well in their efforts to stay in compliance and operate soundly.

Andrew’s dedication to service goes beyond his nonprofit client work. He’s the treasurer for CHOAIDS, an organization that provides education and care to Haitian orphaned children and women who are HIV positive. He also wrote the benevolence funds policy at his church and currently serves on the benevolence team.

Becca Gilbert

Business Development Manager

Becca supports our firm’s Nonprofit Services Team as they strive to meet business goals. Her work involves developing relationships with potential clients, listening to their concerns, and connecting them with professionals who offer the solutions they need. She also oversees our business development program for younger staff, coaching them on building connections with clients and ensuring the highest level of service for them.

Becca’s career has spanned nearly 30 years as a “boots on the ground” business developer. She has an extensive track record of helping companies expand beyond state boundaries and saturated markets to better serve clients and drive business growth.