HKFS Planning Strategies: Proposed Changes to IRA Rules

Originally published on July 30, 2019

Updated on November 14th, 2024

There are three major changes to IRAs currently being proposed in the legislature. You will want to talk with your financial advisor about these changes to make sure you have a plan in place to address them and take advantage of any potential new opportunities.

Proposed legislation in the House of Representatives called “The Setting Every Community Up for Retirement Enhancement Act of 2019,” (the SECURE Act) was passed at the end of May. The Senate is considering a similar bill, the “Retirement Enhancement and Savings Act” (RESA). The stated goal is to expand retirement savings opportunities to more people, and to accelerate tax revenues as a means to pay for the proposed changes. There are many proposals in the two bills; this article will focus on changes to IRAs.

Change #1: Repeal of Maximum Age for Traditional IRA Contributions

The House legislation eliminates the age limit and allows individuals at any age to contribute if they have earned income. Roth IRA contributions have been allowed at any age for those with earned income under certain income limits ($137,000 for single filers and $203,000 for married couples filing jointly). “The current law allows a married 72-year-old couple in which at least one spouse had earned income of $15,000 to contribute $14,000 to Roth IRAs. If the proposed changes are enacted, they could also contribute to a traditional IRA and prospectively deduct their contributions.”1 This change acknowledges that people are working beyond age 70 and the ability to contribute pre-tax to an IRA will help their retirement savings.

Planning Opportunities:

- Traditional IRA contributions reduce AGI, and that can help reduce taxes on social security, Medicare premiums and overall tax rates.

- It may allow for medical expense deductions if the person itemizes.

- Contributions can grow tax deferred.

Change #2: Increase in Age for Required Beginning Date for Mandatory Distributions

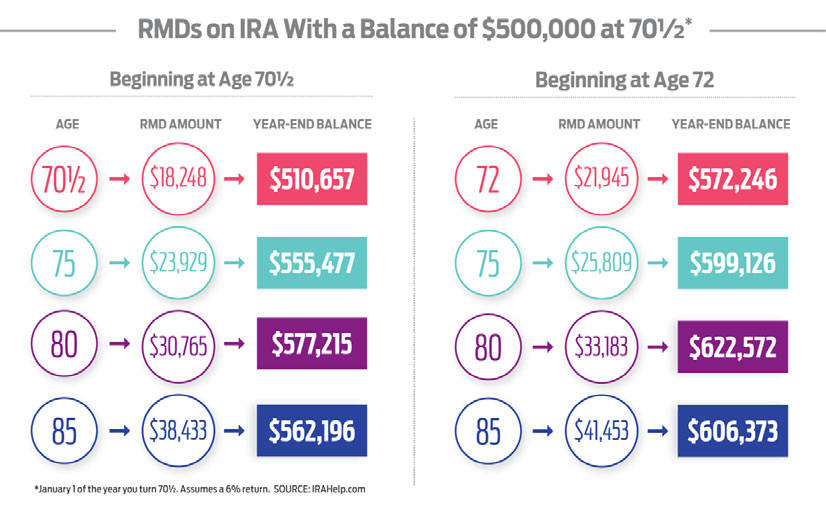

The House bill increases the age for required minimum distributions from 70 ½ to 72. The increase in the age is intended to account for today’s longer life expectancies compared with when the original legislation was passed. The impact may be that RMDs will be larger when taken because of the additional year and a half of tax-deferred growth. The following chart from Kiplinger’s Personal Finance2 shows the difference between RMDs taken at 70 ½ and 72, assuming a 6% annual growth rate.

Planning Opportunities:

- The older starting age for RMDs may provide more opportunity for individuals to make Roth conversions in years when their taxable income is lower. Roth Conversions may make sense in the early retirement years before RMDs increase the retirees’ taxable income.

- If not Roth Conversions, taking IRA distributions in early retirement to fill up lower tax brackets with income can be beneficial for those with large IRAs. Retirees will eventually have to pay taxes on the IRA money, and this allows them to pay the tax at a lower rate.

Change #3: Modifications to Required Minimum Distribution Rules

This change in the House version of the bill effectively eliminates the stretch IRA for inherited (non-spouse) IRA beneficiaries. Non-spouse IRA beneficiaries will be required to fully distribute the IRA to themselves by the end of the 10th year following the IRA owner’s death. This has obvious tax consequences for the beneficiary and the intent is to accelerate tax revenue to pay for other proposed changes, such as the delay of required minimum distributions to age 72.

“The Senate version allows a stretch on the first $400,000 of aggregated IRAs and the exceeding balance must be distributed within 5 years. Both versions allow exceptions for distributions to minor children, disabled or chronically ill beneficiaries, or beneficiaries not more than 10 years younger than the deceased IRA owner. Both versions would apply to inherited IRAs for deaths after 12/31/2019.”3

Senate Finance Committee Chairman Chuck Grassley, R-Iowa, stated that the RESA bill “maintains this savings option for people who inherit an IRA or retirement account, but it places a limit on how large an account can be inherited on a tax-protected basis. This is a common sense approach to encourage the next generation to save for retirement while ensuring that the changes in this bill are fiscally responsible.”4

The inherited IRA required distribution rules also apply to inherited Roth IRAs. While there is no tax on Roth distributions, the required five- or ten-year distribution period will greatly reduce the tax-free growth the stretch would have allowed. The most likely strategy will be to wait until the end of the required distribution period and take the full amount of the Roth at that time.

Planning Opportunities:

- Roth IRAs and Roth Conversions will be more attractive for tax and estate planning purposes.

- Taking traditional IRA distributions in lower income years to maximize lower tax brackets will also reduce the amount in IRAs that get passed on to kids.

- Other planning options that do not result in higher taxes for children inheritors will be considered:

- Life insurance death benefits are tax free to the beneficiary.

- QCDs (qualified charitable distributions from IRAs or 401(k)s) can be used to reduce the IRA amount passed on to heirs.

- Charitable remainder trusts may be more popular to avoid giving kids a huge taxable asset.

We will keep you updated as the legislation progresses. We recommend reviewing your retirement portfolio, tax projection and estate plan in light of these proposed changes. Assuming some version of the two bills passes, conducting a pre-review with your advisor will put you in position to take the most appropriate actions for your needs. Please contact your wealth management CPAs and your HKFS Financial Planning Consultant to discuss specific situations.

1 “Bigger IRAs? Proposed New Tax Law May Let You Build a Bigger IRA in Retirement,” Leon Labrecque, Forbes, April 9, 2019; https://www.forbes.com/sites/leonlabrecque/2019/04/09/bigger‐iras‐proposed‐new‐tax‐law‐may‐let‐you‐build‐a‐bigger‐ira‐inretirement/#12b77aa9d3eb

2 “New Law Could Change Rules for IRA Withdrawals,” Kimberly Lankford, Kiplinger’s Personal Finance, June 5, 2019; https://www.kiplinger.com/article/retirement/t032-c000-s002-new-law-could-change-rules-for-ira-withdrawals.html

3 “New Proposed Stretch IRA Rules Will Have A Big Effect On IRAs And It Could Cost Your Kids Thousands,” Leon LaBrecque, Forbes, April 23, 2019; https://www.forbes.com/sites/leonlabrecque/2019/04/23/new‐proposed‐stretch‐ira‐rules‐will‐have‐a‐big‐effect‐oniras‐and‐it‐could‐cost‐your‐kids‐thousands/#1a80f36f2233

4 “What to Know About the 2 Big Retirement Bills in Congress,” Melanie Waddell, ThinkAdvisor, April 5, 2019; https://www.thinkadvisor.com/2019/04/05/what‐to‐know‐about‐the‐2‐big‐retirement‐bills‐in‐congress/

While this communication may be used to promote or market a transaction or an idea that is discussed in this publication, it is intended to provide general information only about the subject matter covered and is provided with the understanding that neither HK Financial Services nor ProEquities is rendering legal, accounting or tax advice. It is not a marketed opinion and may not be used to avoid penalties under the Internal Revenue Code. You should consult with your CPA, legal counsel or other appropriate advisors on all matters pertaining to legal, accounting or tax obligations and requirements.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like