New Guidance for Claiming the Employee Retention Credit (ERC)

Originally published on March 11, 2021

Employers, take note! New information has been released by the Internal Revenue Service (IRS) regarding eligibility for the employee retention tax credit (ERC).

Originally part of the CARES Act in 2020, the ERC was created to encourage businesses to keep workers on the payroll instead of laying them off during the COVID-19 pandemic. The COVID relief package passed in December, however, expanded eligibility for these credits. Businesses that took PPP loans in 2020 are now eligible to also apply for employee retention tax credits retroactively.

The IRS has since released Notice 2021-20 to clarify and describe these retroactive changes. It also answers questions about employer eligibility, suspension of trade or business operations, qualified wages and more. And as of March 11 week, the American Rescue Plan Act of 2021 (ARPA) expanded the credits even further. We’ve summarized the resulting changes.

If my business received a PPP loan in 2020 and I’ve applied for forgiveness, can I claim the ERC?

Maybe. Payroll costs reported on the PPP loan forgiveness application and included in the forgivable portion of the loan are not eligible for the ERC. If payroll costs exceed the amount of loan forgiven, however, the excess may be eligible.

How do I apply for these credits?

You can apply for 2020 credits by amending the Form 941 for the quarter during which your business is eligible to take them. (Note that owners of businesses who own more than 50% of the company are not eligible to receive the ERC on their wages or the wages of any related individuals.)

The ERC is also available through Dec. 31, 2021. To apply, you’ll need to measure your business’ gross receipts in Q1 2021 as compared to Q1 2019. If the gross receipts are at least 20% less than the comparable quarter in 2019, you may be eligible for the credit. As a safe harbor, you can also use the immediately preceding quarter to qualify. For example, if Q4 2020 was more than 20% less than Q4 2019, you are eligible in Q1 2021. This safe harbor would also apply when filing Q2 2021.

In addition, the credit in 2021 equals 70% of qualified wages (up to $10,000 in wages) for a maximum credit per employee of $7,000 per quarter. If you qualify, you could receive up to $28,000 per employee for the 2021 calendar year.

The ARPA also created additional eligibility for businesses that began their business after Feb. 15, 2020; these are known as recovery startup businesses. The law also creates a category called severely financially distressed for employers whose gross receipts in 2021 have declined more than 90% as compared to the same quarter in 2019. These additions apply to quarters 3 and 4 of 2021. If your business meets either of these criteria, you should consult with your tax preparer.

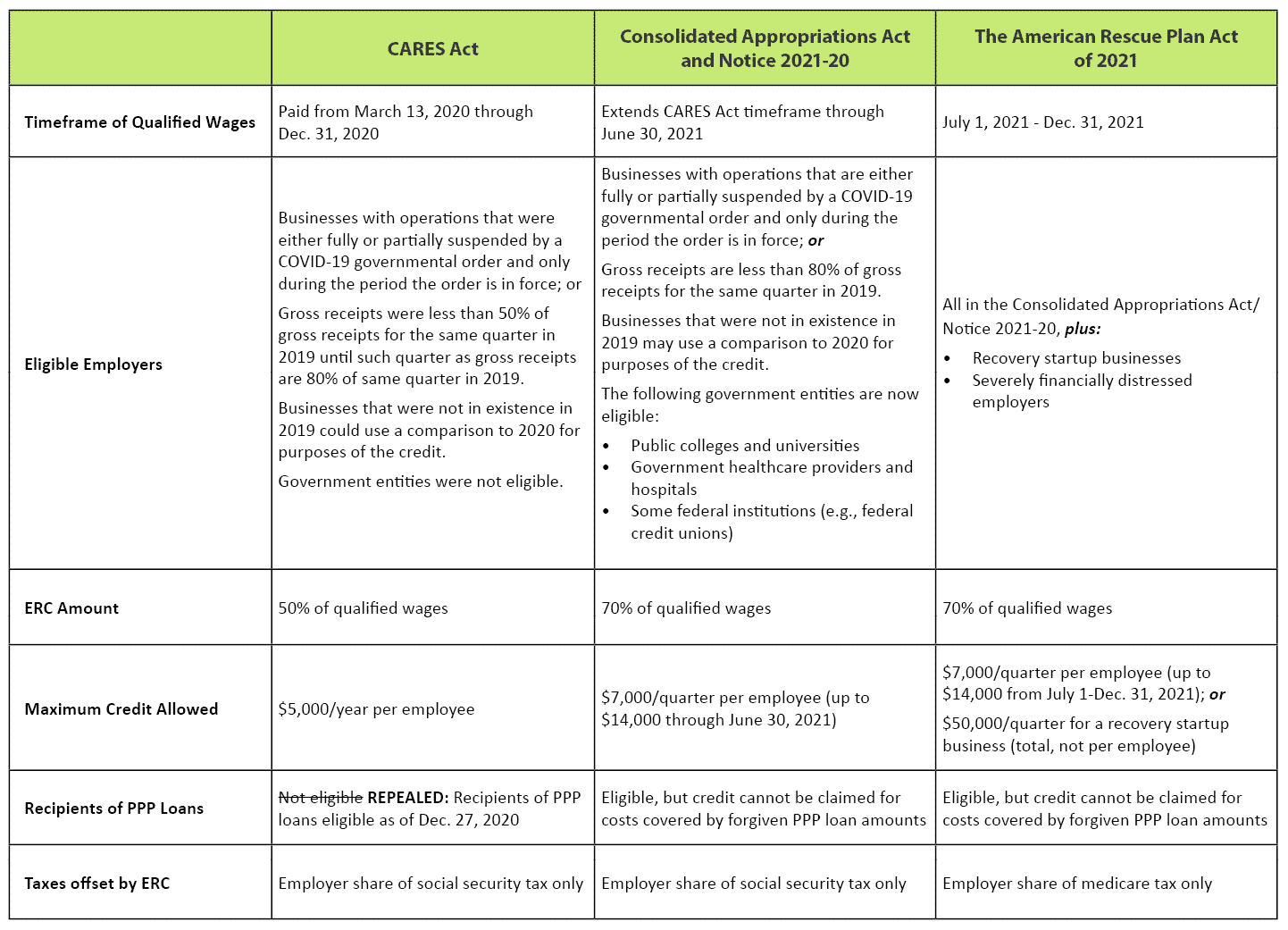

The following table summarizes the differences between ERCs under the CARES Act and now under the CAA and the latest IRS notice. We recommend you check with your tax advisor to see if your business or organization can benefit from these developments.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like