What is a Proforma, and How Can It Help Your Real Estate Fund?

Originally published on November 10, 2023

Updated on December 19th, 2024

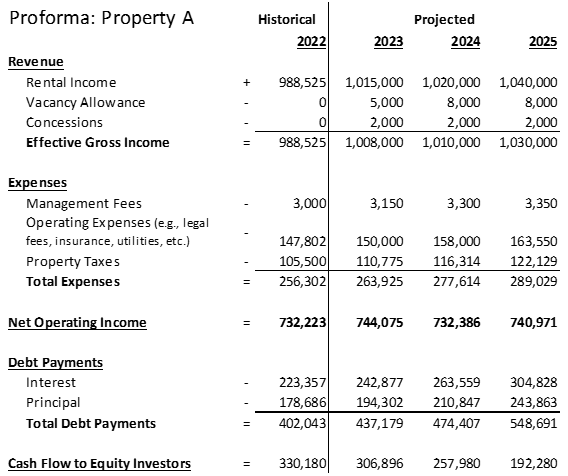

While a proforma is a projection of a property’s rental income and expenses, you can also think of it as a cash flow projection. It typically forecasts future income and expenses for a property or set of properties and estimates the remaining cash that will ultimately flow to investors.

Proformas are great tools for real estate fund sponsors conducting financial due diligence on properties to include in their fund. But they’re only helpful when they are accurate. If you make even a small error in your calculation, that poor assumption can compound as those cash values get projected years into the future.

What does a proforma look like?

Because a proforma isn’t an official report, you can build yours to look however you’d like. Most real estate proformas look something like this:

The data for the most recently completed fiscal year is presented first. Estimated (projected) financial information for one or more future fiscal years in columns to its right.

How do you calculate a proforma?

To create an accurate real estate proforma, your accountant will most often start with the financial data from the property’s most recently completed fiscal year. They will then estimate future income/expenses using these historical numbers as a starting point. These numbers are tweaked for likely changes such as:

- Anticipated interest rate changes

- Anticipated changes in capital structure

- Planned rent increases

- Estimated cost increases (for changes in utility usage, utility rates, insurance coverage, etc.)

- Expected changes in vacancy rates

- Planned capital expenditures (e.g., replacing HVAC systems, repairing a fence, electrical updates, etc.)

Why aren’t income taxes or depreciation included in a proforma?

Because a proforma is a projection of cash, non-cash items like depreciation should be excluded. Also, even though income taxes are paid in cash, they don’t belong on your proforma either. Most real estate funds are established as pass-through entities, which means taxes are paid directly by the investors, not by the business.

Each partner’s or shareholder’s tax liability will vary based on their individual circumstances, so it’s impossible for the business to predict how taxes will play a role. If investors want to understand how income taxes will affect their individual investment, they must calculate that separately.

When do you need a proforma?

A proforma is effectively a snapshot of your property’s current and projected performance. There are a few times you might use (or request) one.

To evaluate your property’s performance and project future cash flows

Internally, proformas are great tools for real estate fund sponsors. Not only do they show the cash inflows and outflows of each property—something income statements and tax returns don’t do—they can also predict future cash flows. Knowing approximately how much cash you’ll have in future years can help you make better investment decisions today. For example, a proforma may help you determine whether you should:

- Sell property in your portfolio

- Increase your investment in certain properties or types of properties

- Pull investments from certain geographic locations

- Change your capital structure

- Invest in capital improvements for your properties

- Negotiate with your bank for better rates or terms

- Find new tenants

- Change marketing practices

Property proformas are also great reports to provide to your passive investors so they understand how their investments are performing.

To see how interest rate changes would impact overall profitability.

Interest rates can have a significant financial impact on real estate businesses, especially during turbulent times when they often fluctuate wildly. This can make it difficult for real estate businesses to project future revenues and expenses.

When interest rates rise, real estate fund sponsors often choose to change their capital structure. Many focus less on debt and instead put their efforts into expanding capital through equity. Proformas can help assess not only how interest rate changes impact overall profitability, but also how changes in your debt service ratio or your debt-to-equity ratios will impact your investors’ take-home cash.

To determine which improvements to make

A “value add” property is one that the purchaser plans to renovate, rebrand or improve so it can operate at its full potential (and therefore pull in higher revenues). Value add properties can be tricky. Investors know they must make capital improvements if they want to raise rent prices. However, it can be difficult to know which capital improvements will ultimately be recouped by future cash flows.

Your accountant can create proformas of different scenarios to help you determine which improvements will be most profitable. For example, an investor purchasing a Class C property could improve their property to Class B or Class A. A proforma can help determine which level of capital investment will provide a better return.

To encourage potential investors to join your real estate fund

Investors want to know what their anticipated returns would be if they join your real estate fund. If you find a new piece of property you’d like to acquire, a proforma can help entice them. Proformas from other properties you manage may also be helpful selling points. This could show that (1) similar investments are producing worthwhile returns, and (2) you have experience managing a real estate fund and will work hard to protect their investment too.

To identify new investment property.

If you’re interested in a piece of property, your accountant can create a proforma to estimate its future cash flows. Even if the seller provides a proforma, it’s smart for your accountant to create one for you from scratch. Proformas are estimates, and the seller may inflate income or downplay expenses to make their property more enticing. A few common things to watch out for in a seller’s proforma are:

- Expenses expressed as a percentage of rental income rather than being listed individually

- Inflation or interest rate assumptions not reflective of the current market

- Vacancy rates not reflective of that property’s specific geographic region

- No or low allowance for vacancies when in between tenants

- Common expenses missing from the report, like cost of repairs and maintenance or HOA fees

Another reason to have your accountant build a proforma is so they can calculate the potential property’s financial ratios. There are several that help you determine if a property is worth pursuing:

- Net Operating Income (NOI) – Expected cash on hand before taxes and debt payments

- Capitalization Rate (Cap Rate) – Expected return based on the property’s market value

- Cash-on-Cash Return (CoC) – Cash income earned on the cash invested in a property

- Internal Rate of Return (IRR) – Annual return on your cash investment

- Return on Investment (ROI) – Overall return on your cash investment since the fund’s onset

Finally, understand that while proformas are tools, they aren’t always perfect. An investment that looks good on paper—even with accurate estimates and conservative assumptions—may still fail to produce a healthy return on investment. But proformas are a great way to alleviate as many investment risks as you can.

If you’re looking for a deeper dive into the accounting and finance basics of setting up a real estate fund, we recommend you read our Comprehensive Guide to Accounting for Real Estate Funds.

And if you want to learn more about real estate proformas, reach out to our James Moore real estate team. We like helping investors make better financial decisions and would love to help your fund succeed.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like