How Sky-High Insurance Premiums Affect Your Real Estate Fund

Originally published on February 16, 2024

Updated on December 19th, 2024

The insurance market (especially in Florida) is changing, with rates rising faster than rental businesses can displace costs onto tenants. And in areas with especially high insurance premiums, property owners are opting for self-insurance or dropping coverage altogether. Although this is only one expense among many that you’ll have to account for in your real estate fund, the insurance market’s volatility is something to take note of when managing a real estate fund.

What’s happening to property insurance?

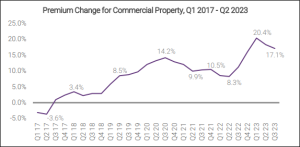

The Commercial Property/Casualty Market Index Survey for Q3 2023 shows that insurance premiums have been rising for 24 straight quarters. In the third quarter of 2023 alone, commercial property insurance rose 17.1% on average. Premiums for properties in higher risk areas saw even greater jumps — up to 45.4% in some areas.

Source: The Council’s Commercial Property/Casualty Market Index Survey, Q3 2023

Survey respondents attributed these price increases to two factors: high reinsurance costs, and lack of reinsurance capacity. Climate change-induced atypical weather patterns have been increasingly common across the country, and reinsurance companies are struggling to cover losses from natural disasters. When these weather-related losses are combined with rising inflation, it’s no surprise that insurance companies are passing those costs on to policyholders.

How are rising insurance premiums affecting property appraisals?

Several factors contribute to a property’s value, including:

- The building’s location

- The building’s age

- Materials used in construction

- The cost to rebuild the property

- The property’s fire rating

- The property’s claim history

- Your claim history as the insured party

- The type of policy you select

- Your credit rating

For rental real estate businesses, your fund’s capitalization rate (or rate of return) also matters. You can estimate your property’s market value by dividing your property’s net operating income by your estimated or presumed cap rate.

|

Market Value of Property |

= |

NOI

|

|

Cap Rate |

As you may guess, the market value of your property will change when rental income and expenses change. This means that if insurance premiums get more expensive, the market value of your property is likely to fall.

Let’s look at an example. If you have a cap rate of 6% and are generating NOI of $60,000, your property would be worth $1 million. If all else stayed the same but your insurance costs increased by $10,000, the market value of your property would fall 16.7%, from $1 million to $833,000.

What can you do about rising insurance rates?

Higher insurance premiums will shrink your bottom line and reduce the market value of your rental property. However, you might be able to take steps to mitigate those negative effects.

Recoup property taxes.

Property taxes can be one of the most expensive line items on your income statement, and they’re directly impacted by your property’s appraised value. If your insurance premiums have risen, you may be able to argue that property values should have a corresponding decrease for property tax purposes. With any luck, you can recoup some of those taxes.

Evaluate coverage.

With higher insurance premiums comes an increased importance to ensure you’re not over insured (or more importantly, under insured). Work with your insurance broker to find any gaps in your coverage in the event of a loss.

Evaluate rent levels.

The unprecedented rise in insurance premiums affects all property owners and will increase the levels of rents in the market. The best property owners constantly evaluate rent levels to make sure that their property is in line with the market. They also watch for opportunities to improve the property to improve the amount of rents that can be charged.

Real estate fund managers need to put insurance costs high on their priority lists. Although you might not be able to lower your insurance premiums, it might be possible to at least soften the blow. Reach out to our real estate fund experts at James Moore to learn more.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like