The IRS Form 990: It’s Not Just for Taxes Anymore!

Originally published on June 26, 2017

Updated on December 6th, 2024

Your IRS Form 990 is critical in demonstrating compliance with IRS regulations and informs the public about your programs, expenditures, and compensation. But the information it contains can also be a valuable marketing tool.

Wait… a tax form? For marketing?

Absolutely! Your 990 is a trove of evidence that you’re dedicated to serving those who truly need you. It’s just a matter of knowing how to use that information. Here are a couple of ideas:

Demonstrate how much of your budget goes toward your actual work.

Donors (and the general public) are wary of organizations that tout their nonprofit status but use large portions of their funding on administrative bloat and executive perks. While technically not considered profit, such expenses are often seen as unnecessary and conflicting with a nonprofit’s benevolent mission.

You can use your Form 990 to demonstrate the amount of each dollar you spend that supports your programs as opposed to other costs. The higher this number, the more you appear to prioritize the true mission of your nonprofit.

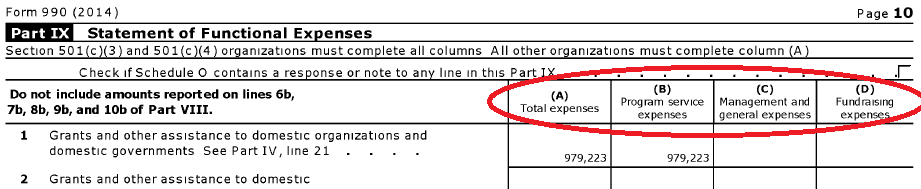

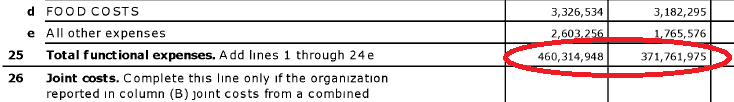

To get this figure, go to the Statement of Functional Expenses (page 10) on the 990. This chart breaks down your total expenses into three categories: program service expenses, management and general expenses, and fundraising expenses (click on photos to magnify):

At the bottom of this page, you’ll see the total for each column. Divide the total program service expenses by the total expenses and you’ll get the number of cents per dollar that you spend directly on the work of your nonprofit (as opposed to administrative and other costs).

You can also convert this figure to a percentage (for example, “80% of our spending” vs. “80 cents of every dollar we spend). Whatever format you choose, a high number here goes a long way toward encouraging financial and community support.

Publicize your accomplishments.

You’ve probably heard that a resume should be more than just a list of responsibilities; it should state specific accomplishments to show that you make an impact.

The same is true for today’s nonprofits. It’s one thing to talk about what you do on a regular basis, but promoting specific accomplishments (preferably with hard figures or facts) demonstrate that you’re truly making a difference with your constituents.

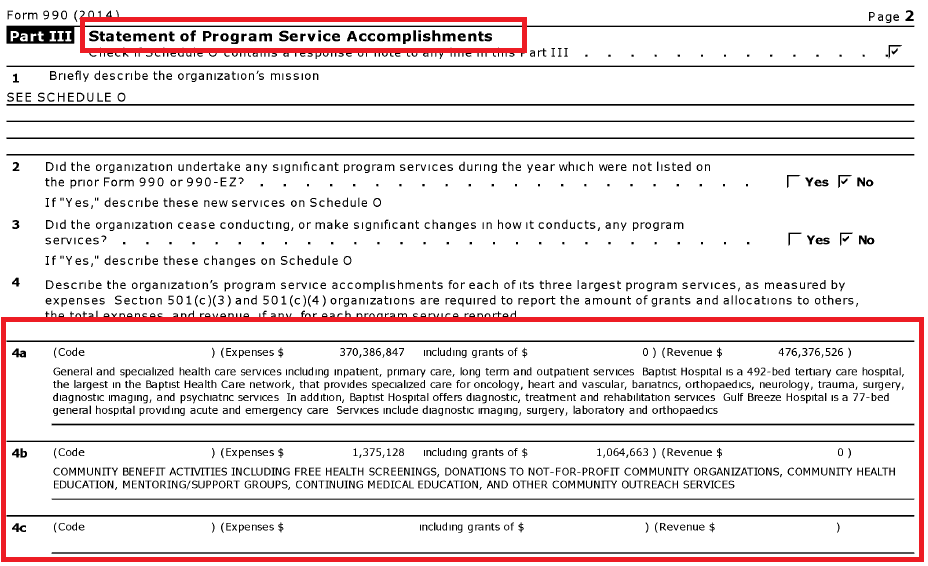

Page 2 of your 990 describes your organization’s mission. It also gives you places to add specific aspects and accomplishments of your services:

For example, you could state how many people you serve, the number of beds you have (great for a shelter or healthcare facility), even a percentage reduction in a key statistic (“Our rescue’s efforts have reduced the number of stray animal euthanizations in our city from 150 per year to 45 per year”).

With rising competition for donors and dwindling sources of funds, you need every advantage you can get to promote your nonprofit. By getting creative with seemingly dry financial information, you can capture your audience’s attention and increase your chances of success.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like