New Lease Standards – Clarifying the Differences in FASB vs. GASB

Originally published on July 23, 2019

Updated on November 14th, 2024

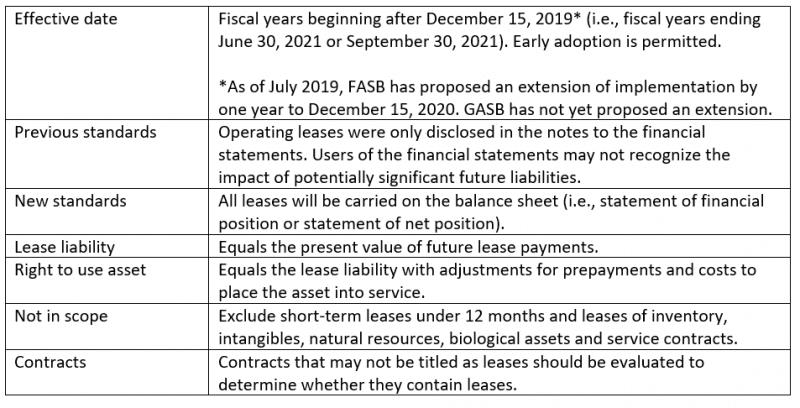

In early 2016, the Financial Accounting Standards Board (FASB) issued an updated lease accounting standard. The new standard, ASC 842, requires entities that lease property or equipment through operating leases to account for these leases on their balance sheet instead of an annual operating expense.

Following suit, in June 2017, the Government Accounting Standards Board (GASB) issued a similar updated lease accounting standard GASB 87 for accounting treatment by state and local governments. Both lease standards are effective for fiscal years beginning after December 15, 2019 (except for public companies, where adoption of the FASB standard is a year earlier).

So since 2016-2017, a broad range of entities from corporations to nonprofits to governments have been hearing about this new lease standard coming that’s going to potentially significantly impact financial reporting. Entities in the higher education and public broadcasting industries (most with fiscal years ending June 30) will have had up to five years before implementation in their fiscal year ended June 30, 2021 financial statements. These entities could report their financials under FASB or GASB basis, depending on the governing requirements placed on them.

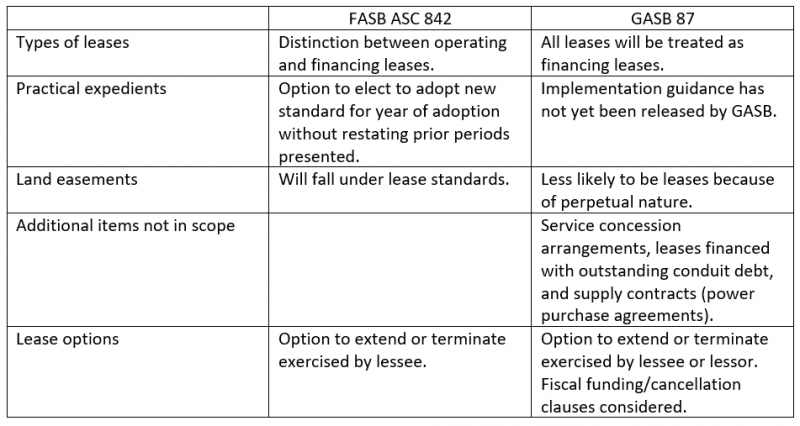

As the financial professionals within those industries attend educational seminars or read literature on the new lease standard, it could be easy for the lines to get blurred and the requirements under each to become confusing. Here’s a quick reference to summarize the similarities and differences between the new FASB and GASB lease standards.

Similarities

Differences

Public companies that have started ASC 842 implementation have reported that they need more time and resources than anticipated to implement the lease standards. While early adoption is permitted and encouraged by some, we don’t advocate early adoption; however, we strongly recommend that you begin preparing for implementation as soon as possible.

What does this mean to you?

- Inventory your leases.

- Review contracts previously not accounted for as leases to determine if they contain leases.

- Capture data according to the new standard.

- Re-examine technology systems used to track leases.

- Develop appropriate accounting policies.

Begin extracting information such as:

- Lease term and rents (timing and amounts)

- Renewal option terms and rents

- Contingent rent/percentage rent terms

- Residual guarantee terms

- Purchase option terms

- Service elements in leases

You can see the entire FASB ASC 842 and GASB 87 lease standards here. Additionally, GASB has issued Implementation Guide No. 2019-3 to clarify and elaborate on the requirements of GASB 87.

We recommend that you contact your higher education industry CPA if you have any questions about these lease standards and what they mean for you.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like