Well-Being Study Highlights New Concerns Around NIL

Originally published on June 1, 2022

Updated on December 19th, 2024

If the pandemic has taught us anything, it’s that well-being is just as important as productivity. And sadly, mental health issues have surpassed the crisis point for many young people. While we express our sincere concern for the emotional safety of your athletes, we are not experts in mental health. So today we’ll speak on what we do know—a large piece of the “NIL support pie” that presents a new concern for your athletes.

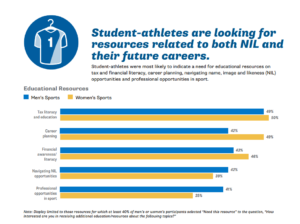

An NCAA study from the fall of 2021 found that as much as half of participants in men’s and women’s sports want more educational resources regarding fiscal management. Specifically, they sought assistance with:

- Tax literacy and education (49% of men, 50% of women)

- Financial awareness/literacy (43% of men, 46% of women)

- Navigating NIL opportunities (42% of men, 39% of women)

- Career planning (44% of men, 50% of women)

Graph from NCAA Student-Athlete Well-Being Study, published May 2022

Facing real-life financial matters is scary for any student heading into adulthood. But in this era of NIL, student-athletes feel that pressure well before graduation. With immediate earning opportunities, they’re facing the tax impact far sooner as a result.

And the reality is, a lot of them simply aren’t prepared. We’ve heard directly about athletes signing substantial deals but having no idea what a 1099 is (or that they’d have to pay taxes on it). Many have never completed an income tax return. They’re navigating non-cash compensation like loaner cars or free products. They can face a variety of tax types – federal income, state income, self-employment, etc. They could also have Pell Grants impacted by NIL earnings.

Of course, all of these hurdles have their own (complicated) rules to follow and forms to complete. Finally, consider the IRS scrutinizing these deals and figuring out how much of these earnings go to the government.

It’s a new and fluid situation for everyone — and it’s a big contributor to the overall well-being of student-athletes.

So how can we protect them? Preparing them for these fiscal challenges can give them peace of mind to handle what lies ahead. That effort includes providing them with the resources and advice they need to responsibly manage their finances. Student-athletes value this type of education much like they value other aspects of their personal well-being.

Where can you start? Tax and other financial literacy education is the low-hanging fruit. Reach out to CPAs well versed in collegiate athletics and the tax and other financial impacts involved. They can guide you on how to educate student-athletes (and yourselves), obtaining free NIL resources (including relevant articles, webinars, state-by-state tax rules and legislative updates, etc.) and other steps you can take.

Let a reputable resource take this off your plate so you can focus on the other aspects of your athletes’ well-being.

All content provided in this article is for informational purposes only. Matters discussed in this article are subject to change. For up-to-date information on this subject please contact a James Moore professional. James Moore will not be held responsible for any claim, loss, damage or inconvenience caused as a result of any information within these pages or any information accessed through this site.

Other Posts You Might Like